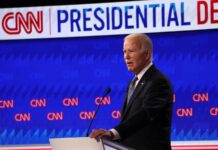

During the 2020 Presidential Campaign cycle, Joe Biden promised his supporters he would advocate for some form of student loan forgiveness. Biden has stuck to his same plan for the most part, saying that he would try to forgive loans under $10,000 for every borrower. Unlike the more progressive members within the Democratic Party who want to push for a more “universal” plan for loan forgiveness, President Biden doesn’t believe that loan forgiveness can be accomplished on such a large scale. Instead, his administration is trying to push an income based forgiveness plan, with the goal of helping those who need it the most. Some Americans believe that loan forgiveness for all would end up benefiting the rich more than the poor. This kind of mindset around loan forgiveness pushes the narrative that some borrowers deserve more help than others. Ultimately, this kind of thinking will only end up hurting all Americans in the long run – regardless of class standing.

This country has instilled the belief that you need a college education in order to have a successful career. This ideology is especially prominent in low-income communities, where a college degree can be a one-way ticket out of poverty. Yet, it was recently reported that there are one million fewer people currently enrolled in college now than before the pandemic started. It would seem that across the board, more Americans are reconsidering the effectiveness of a college degree. For many, the price tag that comes along with pursuing a higher education oftentimes outweigh the benefits. Having a more universal plan for loan forgiveness could potentially ease this anxiety for many prospective students.

It is important to understand the demographic of Americans who currently hold the most student loan debt. Households with an income of over $74,000 hold roughly 60% of the total public student loan debt. Furthermore, households that earn $35,000 or less a year hold roughly 20% of the total public student loan debt. These numbers paint a very specific picture of the type of borrower who holds substantial student debt. A student who comes from a middle class family, whose parents’ combined income disqualifies them from receiving grants. The middle class in this country is starting to become somewhat of a folktale. As the wealth disparity continues to grow in this country, the middle class is starting to become borderline nonexistent. It would be foolish to not attribute the growing burden of student loans to this economic dilemma.

The Biden Administration’s current proposal for allowing borrowers who make less than $125,000 per year to qualify for loan forgiveness sounds practical in theory. It would ensure that members in low-income households and those emerging from the middle class would receive some form of assistance. While a more universal loan forgiveness approach would ultimately benefit all Americans, an income base program is also beneficial. The Biden Administration needs to pass some form of student loan forgiveness sooner rather than later. The administration’s lack of action will cost them greatly, especially if Biden wishes to run for reelection in 2024.