There is yet another great divide among U.S. citizens when it comes to borrowed money. Although there are other forms of debt, student loans are often one of the primary topics that come up. While the issue is highly complex and requires multiple perspectives to understand what can be done to help those enduring the hardships being debt-ridden, most arguments are often boiled down into whether or not borrowers deserve relief.

The idea that workers deserve comfort and compassion, especially in times where both are extremely difficult to achieve, is frequently misconstrued by arguing statements such as “it is unfair to those who worked hard to pay off their debt.” These viewpoints normalize the unnecessary suffering that the debt-ridden working class endures under a system of unchecked, exploitative capitalism. It is not wrong to say that those who preach these notions ultimately, although unintentionally, function as corporate assets.

Postsecondary education was intended to be a means to gain a better understanding of the world. While it still has that foundation, elites have found a way to devalue higher education while simultaneously profiting from it through privatization, turning academia into a risky, futile investment rather than the educational opportunity it should be.

Privatization of postsecondary education comes in two basic forms: the simple, direct exclusion of lower income brackets by establishing private universities only they can afford, and student debt. Student debt is a bit more immoral in nature, as it takes advantage of students without high-income resources through interest. Interest rates are used to siphon every cent off of borrowers, leaving debt that could take up to two decades before fully repaying it.

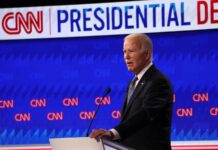

There have been recent, more direct efforts that are aimed at combating the unnecessary hardships caused by student debt; despite being highly unpopular among politicians, President Biden unveiled a relief package just last year in August, forgiving up to $20,000 dollars of debt on a case-by-case basis. Furthermore, on Jan. 10, the White House proposed a major rework of the repayment system that would allow indebted future and current graduates much more breathing space when it comes to balancing their bills. The plan includes significant reduction of monthly payments, sensible lenience on unpaid interest charges, and improved accessibility for forgiving debt. These efforts were inevitably met with resistance from several Republican politicians. While this was happening, the official White House account tweeted that most of these critics themselves had debts that were forgiven. Opposition to forgiving debt, to some critics, was never to uphold the idea of hard work, but because student debt relief is a path to the removal of another tool that allows the corporate elite to maintain control of the working class.

These politicians also frequently argue that debt relief will cause inflation. However, the resulting inflation would be natural, causing virtually little to no disruption in the economic cycle. In this context, any inflation that may be caused from such forgiveness would be primarily due to corporate efforts to maintain profit margins to compensate for the buying power granted to borrowers as a result of debt alleviation. Those who believe and propagate the idea that inflation is primarily caused by the working class are often putting corporations ahead of people.

A flaw in most arguments against relief, is the oversimplification of how student loans are repaid. Loans aren’t simple neighborly favors where one pays back the exact amount with a little interest thrown in as courtesy. Lending is a business, and it intends to make as much profit as possible. Navient, a student loan servicer, recently paid a landmark settlement as a consequence of pushing predatory loans onto borrowers. Corporations will push their limits beyond the letter of the law in the name of profit. Today, 44 million Americans owe a grand total of $1.7 trillion dollars in student debt. That amount, to businessmen, is profit awaiting due payment. To others, it is money unpaid by “lazy freeloaders,” a narrative that benefits none but the wealthy.