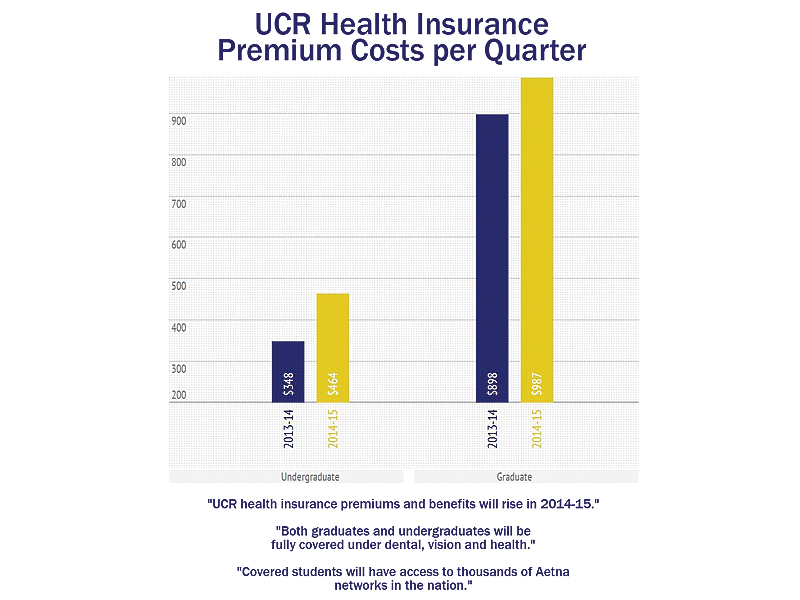

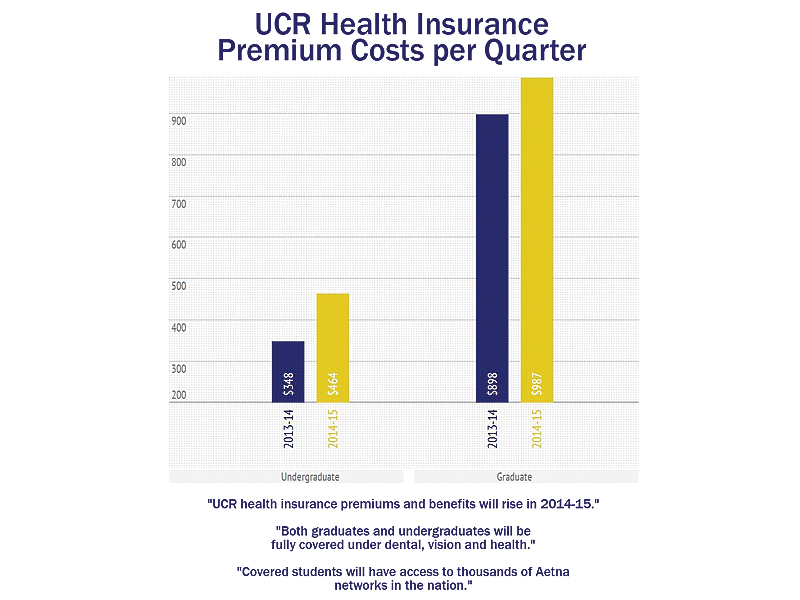

The cost of UCR’s student health insurance plan (SHIP) is expected to rise from $348 to $464 per quarter for undergraduates and from $898 to $987 per quarter for graduates come fall quarter of 2014-15. Under a revised contract with health insurance provider Aetna, SHIP will allow UCR students to be fully insured under dental, vision and health insurance, according to campus representatives.

The campus student health advisory committee (SHAC) — serving as a liaison between the student health center and student body — voted to abandon the UC student health insurance plan (UC SHIP) for undergraduates for the 2013-14 academic year after discovering a systemwide deficit that resulted from poor management. In the same year, UCR graduate students opted out of health insurance for UC SHIP, with the exception of dental and vision.

After contracting with Aetna in 2013-14, UCR undergraduates saw a slight increase in premium rates from $240.29 to $348 — the quarterly amount currently charged to the Growl account of a UCR-insured undergraduate. At the same time, vision and dental coverage experienced minimal change through the Veitch Student Health Center, which only offered four dentists within the campus health center; graduate students were covered under Delta Dental through local dentist offices within a 15-mile radius.

By leaving UC SHIP, UCR gained leverage by establishing an independent medical history for itself, which health care providers could look to as a reference, according to SHAC student representative Sandeep Dhall. This separation, Dhall says, has made it “much easier” for UCR to carve out a specialized and affordable health insurance plan with Aetna.

“So (Aetna has) seen our history of how well-managed we are and that’s how we were able to keep our prices low,” said Dhall. “It’s also a more healthy (and) different population of students that makes us unique.” In fall 2014, both undergraduates and graduates will be covered under a separate Aetna plan, allowing students to seek out nationwide physicians and hospitals that fall under the Aetna network. Despite the upcoming premium increase, UCR still has the lowest premium rates out of the 10 UC campuses.

According to statistics provided by UC media relations specialist Brooke Converse, UC campuses that stayed fully insured with UC SHIP — Merced, San Diego and Santa Cruz — reported an increase of $300 or more for their undergraduates from 2012-13 to 2013-14; with the exception of UCLA, which saw a reduced health insurance premium of about $70. Campuses such as UC Santa Barbara partially opted out of the systemwide health insurance plan and suffered high increases from $1,367.37 to $2,414 in the same period.

Dhall says that campuses that decided to stay in UC SHIP for the 2013-14 academic year will be forced to pay a penalty if they decide to withdraw in the upcoming year. He added that UCR is the only campus to increase its insurance benefits that all other UCs have had to decrease. As more UCs decide to abandon UC SHIP, there will be a smaller pool of students to pay the overhead costs of maintaining it, which may cause existing members to shoulder a higher premium burden in the long run.

Sandeep also said that campuses that are no longer a part of UC SHIP can still provide input through a UC SHIP Forum, which allows campuses to know how each UC is performing in terms of health insurance plans.

Management Services Officer of UCR’s student health services, Rick Von Kolen said contracting with Aetna allows UCR to create a separate student health insurance plan, which prevents individuals insured under Aetna, but not affiliated with the university, from using the student health center.

Another point made by Insurance Coordinator of the student health center Marsha Tolson was that Aetna contracts may change on a year-to-year basis, depending on how often UCR health insurance is used.

The full switch to Aetna was also prompted by the federal Affordable Care Act (ACA), or Obamacare, which enacted many of its provisions on Jan. 1, 2014. A key feature of the federal mandate includes the creation of a health insurance marketplace, where individuals can purchase government-regulated and standardized health care plans, eligible for tax subsidies. The full effects of the ACA require all U.S. citizens to be fully insured or face a penalty contingent on income and family.

UC policies require all students to have the campus health insurance plan, but if they have comparable insurance, then students may fill out a waiver to opt out of it. Aetna also meets the requirements for the ACA, provides a tax subsidy and exempts students under the plan from purchasing a separate health insurance plan. Students enrolled in UCR’s SHIP are exempt from purchasing a plan on the Covered California website or another home-state exchange.

Kolen said federal ACA and non-Aetna insurance plans are not allowed at the UCR student health center. UCR still has no deductible (a specified amount of money that must be paid before an insurance company will pay a claim) for its insurance plan, which is marginally comparable to the “platinum” federal insurance package. Kolen held the concern that students who used to get a separate student health insurance plan will try to waive out for an Obamacare plan. He gave the example where if a person has a $2,000 deductible, then they must pay $2,000 before their insurance plan kicks in, which is “a lot more than a Dodger’s visit” or “one or two x-rays.”

“So if you get sick or if you get injured, these poor students are going to be stuck with these (federal) plans that are making them pay 2K, 3K, 5K off the top,” he said. “And being told, ‘Oh this is the good deal because it’s being subsidized by the government (and) you’ll be covered’ … and you’re not. You’re literally not covered until that … deductible goes away.”

According to President Barack Obama, over eight million people have signed up for a health insurance plan through state or federal exchanges under the ACA so far.

Kolen also says that the insurance plan seeks to go beyond the usual trifecta of health services that consist of dental, vision and medical, and show there are other services that students can take advantage of. Lab testing, x-rays and doctor visits are also a few, free services offered under SHIP.

UCR’s student health insurance is also calculated into a student’s financial aid package. According to director of financial aid, Jose Aguilar, student health insurance fees are included in the cost of attendance (COA): tuition and fees, room and board, books and supplies, transportation and personal costs. “We then take the COA and subtract the Expected Family Contribution (EFC) to come up with the financial aid need.” Aguilar explained.

Financial aid need is covered by a combination of grants, scholarships, loans and work-study based on eligibility requirements for each program type. The EFC is calculated by the U.S. Department of Education using the data students submitted on their Free Application for Federal Student Aid (FAFSA). Aguilar says that students who do not have financial aid need can still apply for federal student loans.