Signed into law on March 27, 2020 by President Donald J. Trump, the Coronavirus Aid, Relief, and Economic Security (CARES) Act allocates $2.2 trillion toward alleviating economic and health burdens resulting from the COVID-19 pandemic.

Among the many provisions the bill provides, the piece of legislation provides direct financial aid to individuals, impacts student loans and allocates money to higher-education institutions for financial assistance and financial aid programs.

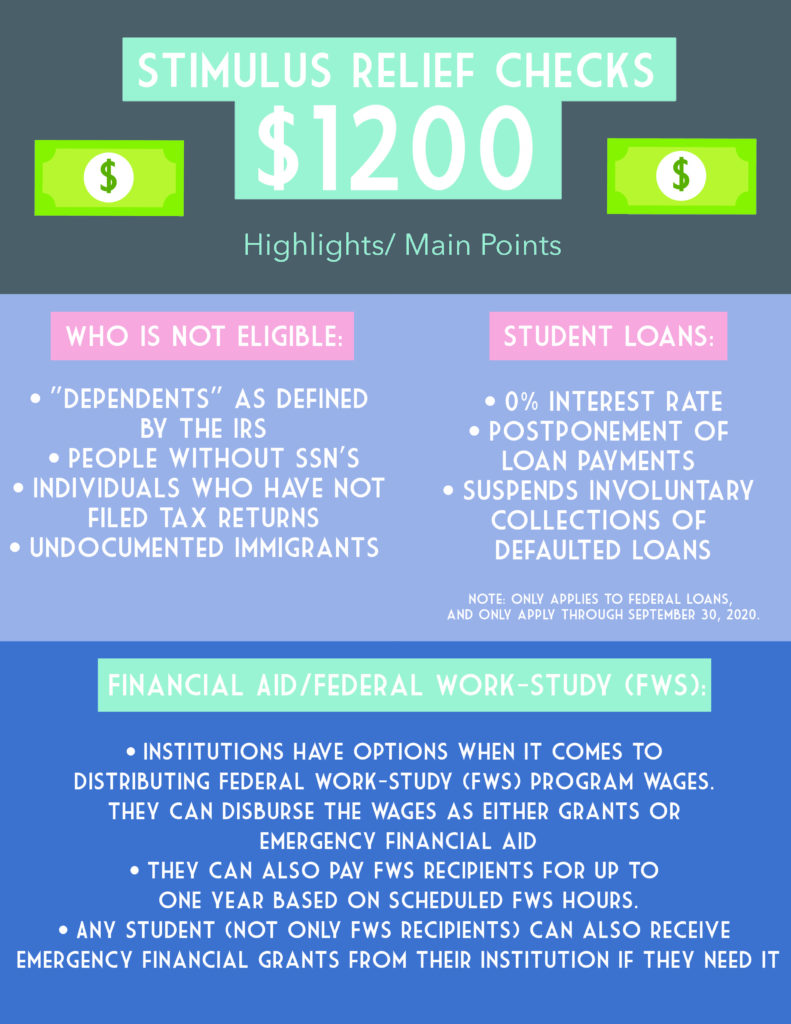

One-time recovery rebates, or stimulus relief checks, will be distributed by the Internal Revenue Service (IRS) to individuals, and will provide $1,200 to eligible individuals. Eligible individuals do not include undocumented immigrants, individuals who have not filed tax returns, non-Social Security Number (SSN) holders orindividuals whose parents claimed them as “dependents” on their tax returns.

According to the IRS, individuals are considered to be a “dependent” and can be claimed by family members as such if they are related, are either under the age of 19 or a full-time student under 24, have lived with family for at least more than six months (there are exceptions for relocation that is education-related) and do not provide more than half of one’s own financial support for the filing year. Christopher Kent, a second-year political science major, stated that “ I was excited to learn that I would be eligible for a [stimulus] check. However, I later found out that I was unable to apply because my parents claim me as a dependent on their taxes, making me, and many other Highlanders, ineligible for the check.”

The bill also allocated $30.75 billion toward an “Education Stabilization Fund,” from which $14.25 billion are directed toward higher education institutions. Universities and colleges, based on their enrollment of Pell-Grant recipients, will receive a certain amount of funds. Institutions are required to use 50% of these funds to provide emergency financial grants to assist students who, due to the COVID-19 pandemic, have unexpected financial expenses. These expenses include food, housing, course materials, technology, health care and child care costs. Campus specific financial aid adjustments and aid differ per institution. UCR students specifically can file an appeal with the proper documentation to recalculate their “Expected Family Contribution” for the 2020-2021 financial aid award year if there’s a significant reduction in income, according to the UC Riverside Office of Financial Aid’s website.

Provisions within the CARE Act automatically suspend involuntary collections of defaulted loans, eliminates the interest rate for loans and suspends payments on most federal students loans through Sept. 30, 2020 for qualifying student loan borrowers. Accruing interest on loans will be adjusted to 0%, meaning that if individuals do choose to repay any portions of their loans during this time, the payments go directly toward the loan principal balance. There are no provisions within the bill pertaining to “student loan forgiveness,” but there are automatic loan forbearances through Sept. 30, 2020, meaning that loan payments can be postponed until that date. However, these provisions only apply to qualifying federal student loans, not private loans. Samuel Roberts, a fourth-year year public policy major, expressed his support for these provisions, stating that they’re a “step in the right direction.” Additionally, he stated that “with the looming recession, I think student loans should ultimately be erased,” and “either halting payments for at least a few years or erasing these debts is necessary to strengthen the economy.”

The CARES Act also waives particular requirements relating to campus-based aid, such as Federal Work-Study (FWS) program wages. Through the bill, institutions are allowed to transfer any remaining FWS funding into the Federal Supplemental Education Opportunity Grant (FSEOG), meaning that the program money may be disbursed through grants. FSEOG funding, through the CARE Act, also allows institutions to provide emergency financial aid.

The bill also allows for institutions to continue providing pay to FWS program recipients for up to one year if the institution’s campus or the student’s employer closes down as a result of the COVID-19 pandemic. The amount of payment will be based on the student’s scheduled FWS hours. The UCR Office of Financial Aid Office’s website states that if FWS students have UCR off-campus jobs that are temporarily suspended, they should reach out to their office to “receive individualized guidance.” Kent stated that “I know of many student workers that do rely on their job and I hope that UCR administration can figure out ways to help those students who are currently out of a job for an indefinite period.”

The CARES Act encompasses many more provisions pertaining to education, and specific details as to how each institution is handling these policies varies. For information regarding UCR’s financial aid disbursements and affairs, students can refer to UCR’s Financial Aid Office’s “FAQ” on their website, https://financialaid.ucr.edu/.