President Donald Trump’s signing of the Coronavirus Aid, Relief and Economic Security (CARES) Act brought relief to the many Americans who face economic insecurity due to the closure of businesses and institutions. The CARES Act included the largest emergency relief bill in American history, a $2 trillion stimulus package that would include one-time payments of $1,200 to eligible Americans. Although the stimulus check would undoubtedly benefit many Americans, the bill excluded many communities — among those, college students who were claimed as dependents and residents without a Social Security number.

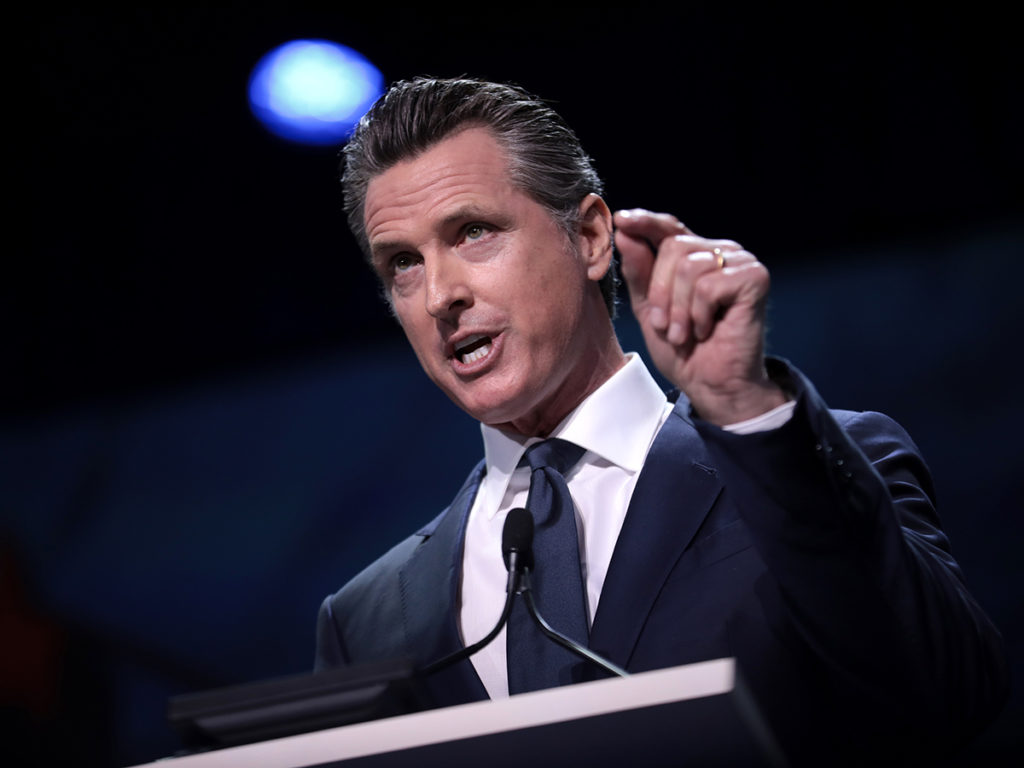

In California, Governor Gavin Newsom has attempted to address this disparity by announcing a $125 million relief effort for people without a Social Security number. Newsom stated that the proposal will grant $500 to individuals and up to $1,000 in relief aid to families upon the completion of an application that will open in May. Already, Newsom has faced significant backlash; the conservative nonprofit Center for American Liberty and two Republican candidates for the state Assembly filed a lawsuit with the California Supreme Court requesting a stay on the governor’s proposal. The CEO for the Center for American Liberty stated that taxpayer money is “not a slush fund for the governor to spend as he sees fit.” However, this argument is not only hypocritical, but it attempts to paint the governor’s action as illicit, when in actuality, he is doing the bare minimum for this marginalized community.

Governor Newsom’s proposal is admirable and $1,000 will surely prove to be beneficial to undocumented families, but it does not compare at all to the aid the CARES Act stimulus checks are providing other Americans. Married filers with two children under 16 receive $3,400 in aid, whereas it appears as if an undocumented family of the same size will receive only $1,000. This is completely unfair considering that undocumented immigrants pay taxes. A report from the Institute on Taxation and Economic Policy, undocumented immigrants paid $11.6 billion in state and local taxes across the nation; in California, undocumented people paid $3.1 billion, the highest number in America.

Undocumented immigrants don’t cost taxpayers money, as much as conservatives may want one to believe the contrary. In most cases, undocumented people are unable to collect a tax refund and are prohibited from using benefits that they pay for, although they contribute billions of dollars in federal and state taxes. It is wholly hypocritical for the plaintiffs to argue that Newsom is using taxpayer money wrongly when the chief actuary of the Social Security Administration has stated himself that the tax dollars of undocumented workers results in a net positive effect on the financial status of the Social Security retirement fund.

Newsom noted that undocumented workers make up 10% of the California workforce and are overrepresented in essential sectors such as healthcare, agriculture and food, manufacturing and construction. Essential undocumented workers are even more vulnerable than documented essential workers considering that many undocumented people across the nation do not have access to affordable healthcare. In California, only undocumented people under the age of 26 are eligible for Medi-Cal, the state’s healthcare program aimed at low-income communities. Any undocumented essential workers above that are left unprotected by the state. Families with undocumented parents will most likely face worse consequences — if one or both parents get sick, they will be unable to receive imperative medical care and their children will lack the financial aid for necessities. Even if rent was extremely low for this hypothetical family — which, living in California, is hard to believe — $1,000 will barely hold a family afloat.

This proposal is a good first step, but Governor Newsom shouldn’t be applauded for doing what is right by granting relief aid to thousands of workers that help his state function. He should be working toward a comprehensive solution that ensures that this marginalized community is supported in the same way as other Americans. Furthermore, states who benefit from the tax dollars of undocumented immigrants —among those who most greatly do is Texas at $1.6 billion and New York at $1.1. billion— need to implement similar systems to support one of the most vulnerable populations in the U.S. right now. As the governor said, it is the “moral and ethical” course of action for states.